@quarterris @Chime why didn't @Chime let customers now that there is problems receiving direct deposits today. My lights just got turned off cause my deposit was supposed to be here at 12 pm My lights just got turned off cause my deposit was supposed to be here at 12 pm. 18 minutes ago Chime direct deposit late. Chime for me has consistently posted shortly right after 10 PM on Wednesdays, albeit tonight posted around 10:57. Chime members with total monthly qualifying direct deposits of 0 or more are eligible to enroll. PayPal is always slower than chime but generally sometime after midnight it shows up. Banking Services provided by The Bancorp Bank or Stride Bank, N.A., Members FDIC. The Chime Visa ® Debit Card is issued by The Bancorp Bank or Stride Bank pursuant to a license from Visa U.S.A. And may be used everywhere Visa debit cards are accepted. Please see back of your Card for its issuing bank.

Whether you’re an employee, independent contractor or somewhere in-between, there’s no denying that getting paid is important. But it can be a drag to go to the bank or use a mobile app to cash or deposit a check. That’s why direct deposit is a great option if you’re looking to access your cash quickly.

Direct deposit is a payment option where your funds are electronically transferred to your checking or savings account. This can help the payee receive payment faster and avoid dealing with physical checks.

Black lotus casino no deposit bonus codes 2019. In many cases, direct deposit means your payroll checks are automatically deposited into your bank account. You would typically set up this type of direct deposit with your employer. But, you can also use direct deposit for tax refunds and other types of payments. The benefit of direct deposit is that funds are seamlessly transferred from the payer to the payee. Like the name suggests, the funds are directly deposited into a bank account for easy and quick access.

If you want to avoid cumbersome checks and ensure you get paid quickly, signing-up for direct deposit is key. Whether you sign-up for direct deposit through your employer, a vendor or another company, typically the process is the same.

Of course, each company may have different forms you need to fill out to process the request. In all likelihood, you’ll need the following types of information:

- Your bank routing number

- Your account number (this is the account you want the funds to go into)

- Your bank’s address

- A voided check

You can think of your routing number as an electronic address that helps ensure that the funds are going to the right neighborhood. Your specific and unique account number, on the other hand, is like your financial home. Both of these numbers help specify exactly where your money should go when you set up direct deposit.

Lastly, your bank’s address and a voided check may be used for additional verification as part of the direct deposit set-up process.

After you learn how to set up direct deposit, you may then want to know how long direct deposit takes to go into effect.

In some cases, it can take one to two pay cycles for direct deposit to be set up properly. This may mean you’ll still have to use physical checks for a little while longer until everything is set up.

Once direct deposit is ready, exactly when your funds will hit can vary depending on factors like what type of payroll software your employer uses and when payroll is submitted. This is important to understand, especially if you are setting up automatic transfers. For example, if your direct deposit won’t hit until 9am on a business day, but an automatic transfer is taken out earlier than that, this can cause problems. Instead, find out exactly when your funds will be available and then schedule your bill payments and automatic transfers after your payment hits.

It’s also important to note that in some cases your financial institution may put a hold on your funds for a couple of days before releasing the money into your account. For this reason, early direct deposit features can be a complete game-changer.

Early direct deposit allows you to access your funds faster than most traditional banks.

There’s nothing worse than knowing that you should already have your money – but your funds are on hold. You have bills to pay and a life to live. If your funds are on hold and you make a payment and don’t have enough in your account, it can spell trouble and even lead to hefty fees like overdraft fees.

That’s why when you direct deposit with Chime, you get access to features early direct deposit¹, overdraft without fees², and more!

Bottom line

If you’re offered the option to sign-up for direct deposit, it’s always a good idea. It not only minimizes paperwork and c

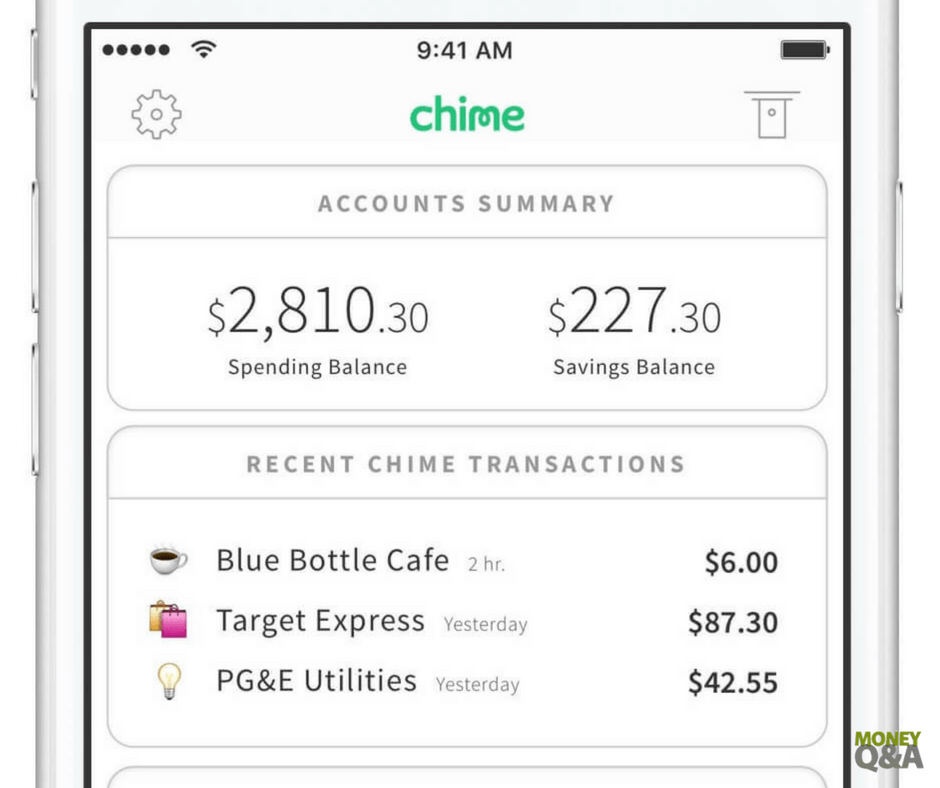

Fee-free overdraft up to $100.¹ Get paid up to 2 days early with direct deposit.² Grow your savings.

Learn how we collect and use your information by visiting our Privacy Policy›

The Bancorp Bank or Stride Bank, N.A.; Members FDIC

Overdraft fee-free with SpotMe

We’ll spot you up to $100 on debit card purchases with no overdraft fees. Eligibility requirements apply.¹

Get paid early

Chime Direct Deposit Holiday Delay

Set up direct deposit and get your paycheck up to 2 days earlier than some of your co-workers!²

Say goodbye to hidden fees³

Chime Bank Direct Deposit Time Reddit

No overdraft. No minimum balance. No monthly fees. No foreign transaction fees. 38,000+ fee-free MoneyPass® and Visa Plus Alliance ATMs. Out-of-network fees apply.

Make your money grow fast

0.50% Annual Percentage Yield (APY)⁴. Set money aside with Automatic Savings features. And never pay a fee on your Savings Account.

Stay in control with alerts

Chime Bank Atm Locations

Chime Direct Deposit Delay

You’re always in-the-know with daily balance notifications and transaction alerts

Security & support you can trust

Serious security

Chime uses secure processes to protect your information and help prevent unauthorized use

Chime Direct Deposit Late

Privacy and protection

Your deposits are FDIC insured up to $250,000 through The Bancorp Bank or Stride Bank N.A.; Members FDIC

Friendly support

Have questions? Send a message to our Member Services team in the app or check out the Help Center.

Get started

Applying for an account is free and takes less than 2 minutes.

It won’t affect your credit score!

Learn how we collect and use your information by visiting our Privacy Policy›